Financial Advisor Cover Letter How To Get Noticed

A well-crafted financial advisor cover letter is your first opportunity to make a strong impression on a potential employer. It’s more than just a formality; it’s a chance to showcase your qualifications, passion for the field, and understanding of the specific role and company. A compelling cover letter can significantly increase your chances of landing an interview and ultimately securing your desired position. This guide provides comprehensive advice on how to write a financial advisor cover letter that grabs attention and sets you apart from the competition. By following these tips, you can create a cover letter that highlights your strengths, demonstrates your value, and persuades the hiring manager to learn more about you.

Understand the Purpose of Your Cover Letter

Before diving into the specifics, understand the fundamental purpose of your cover letter. Unlike your resume, which provides a factual overview of your experience, your cover letter allows you to tell a story. It’s your opportunity to explain why you’re the perfect fit for the job, connecting your skills and experiences to the company’s needs and values. The cover letter’s primary goal is to convince the hiring manager to read your resume and call you for an interview. It should highlight your enthusiasm for the role and the company, demonstrating your genuine interest and your understanding of the financial advisory profession. By clearly stating your career goals and expressing your excitement about the opportunity, you create a positive first impression that increases the likelihood of getting your application noticed. Proper understanding will make your cover letter better.

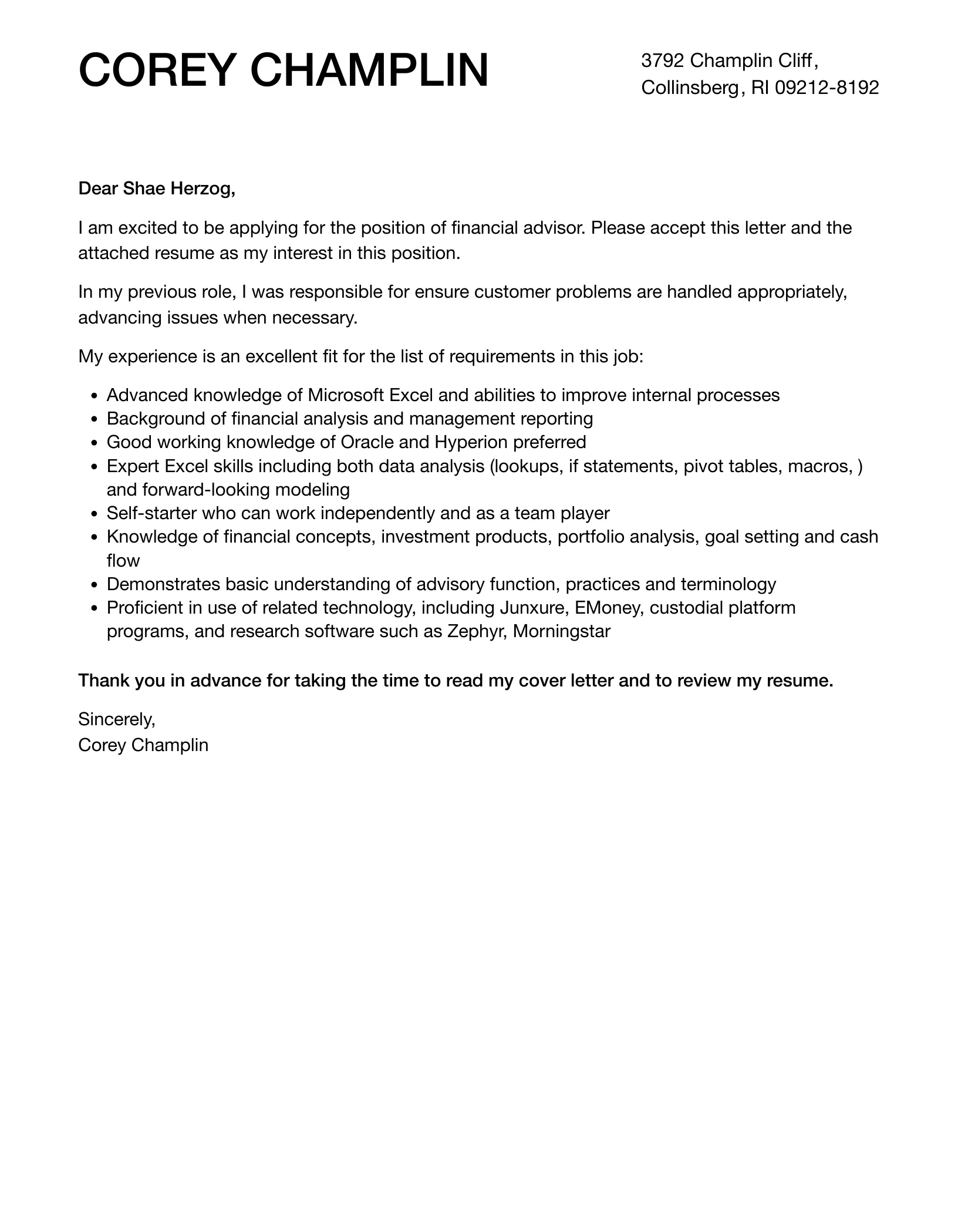

Highlight Your Relevant Skills and Experience

The core of your cover letter should focus on your skills and experience that align with the job description. Identify the key requirements mentioned in the job posting and use those as the foundation for your letter. Provide specific examples of how you’ve utilized those skills in previous roles. For instance, if the job requires experience with investment management, provide examples of successful investment strategies you’ve implemented or the size of portfolios you’ve managed. If the role involves client relationship management, describe your experience building and maintaining strong client relationships, including how you handled challenging situations or exceeded client expectations. Tailor your skill descriptions to match the terminology used in the job description, making it clear that you understand the role’s demands and possess the capabilities to succeed. Do not be afraid to use keywords from the job posting to make it easier for the hiring manager to see your relevant skills at a glance. (Image: financial-advisor-skills.webp)

Tailor Your Cover Letter to the Specific Job

A generic cover letter won’t cut it. You need to tailor each cover letter to the specific job and company you’re applying for. Review the job description carefully and research the company’s mission, values, and recent initiatives. Address the specific needs and challenges mentioned in the job posting and explain how your skills and experience can address them. Show that you’ve taken the time to understand the company’s culture and objectives. Reference specific projects or achievements that are relevant to the role. Personalize your letter by mentioning something that resonates with you about the company, such as its commitment to client service or its innovative approach to financial planning. Tailoring your cover letter demonstrates your genuine interest and attention to detail, increasing your chances of standing out. (Image: job-role.webp)

Showcase Your Achievements and Results

Instead of just listing your responsibilities, highlight your achievements and the results you’ve delivered in previous roles. Quantify your accomplishments whenever possible. Did you increase client assets under management? Did you improve client satisfaction scores? Did you streamline a process that saved the company time or money? Providing concrete evidence of your success will make your cover letter more persuasive. The use of data and metrics adds credibility to your claims and demonstrates your ability to contribute to the company’s bottom line. Frame your achievements in a way that aligns with the job’s requirements. For example, if the role emphasizes client retention, highlight your experience in retaining clients and providing excellent service. Make sure you use the STAR method (Situation, Task, Action, Result) to describe your accomplishments, making them clear and concise. (Image: financial-advisor-achievements.webp)

Quantify Your Accomplishments

Whenever possible, use numbers to showcase your achievements. Numbers provide tangible evidence of your impact and make your claims more compelling. For example, instead of saying “Increased sales,” state “Increased sales by 15% in the first quarter.” Or, instead of “Managed a large portfolio,” say “Managed a portfolio of $10 million.” Include any other specific, measurable results, such as the number of new clients acquired, the amount of revenue generated, or the percentage of client satisfaction. Quantifiable results demonstrate your value and make your accomplishments more impactful to the hiring manager. Make sure your accomplishments align with the needs of the job you are applying for, and avoid using generic statements.

Use Action Verbs to Describe Your Contributions

Start your sentences with strong action verbs to make your descriptions more dynamic and engaging. Action verbs show what you did and make your accomplishments come to life. Instead of saying “Responsible for managing client portfolios,” use “Managed client portfolios, resulting in a 10% increase in client assets.” Some strong action verbs include: managed, developed, implemented, increased, reduced, improved, achieved, generated, and led. Use action verbs throughout your cover letter to showcase your skills, abilities, and achievements to make your cover letter stand out. Ensure the action verbs you choose align with the specific responsibilities and requirements outlined in the job description.

Demonstrate Your Knowledge of the Financial Industry

Show that you have a solid understanding of the financial industry, including current trends, regulations, and challenges. Mention any relevant news or developments that are relevant to the company or the role. This demonstrates that you are not only qualified but also informed and engaged with the profession. Showing your industry knowledge can set you apart from other candidates and prove your ability to think critically about the market and the environment. Highlight any experience with financial planning, investment strategies, retirement planning, or wealth management, depending on the specific role. This will highlight your abilities and make you more attractive to the hiring manager. (Image: financial-industry-knowledge.webp)

Mention Your Professional Certifications

Include your professional certifications and licenses, such as the Certified Financial Planner (CFP) designation, Chartered Financial Analyst (CFA) designation, or Series 7 or 66 licenses. These certifications demonstrate your commitment to the profession, your specialized knowledge, and your adherence to ethical standards. List the certifications prominently and explain what they mean to show their relevance to the job. For example, you can mention that your CFP certification signifies your commitment to providing financial planning services to clients. If you are in the process of obtaining a certification, you may also state this, along with the expected completion date. These will highlight your qualifications and increase your chances of getting hired. (Image: professional-certifications.webp)

Research the Company and Address the Letter Properly

Before you begin writing, research the company thoroughly. Visit their website, read their mission statement, and review their recent news and press releases. Understand the company’s culture and values. Use this information to tailor your cover letter to their specific needs and goals. Addressing the letter to the correct person is crucial. If possible, find the hiring manager’s name and address the letter to them directly. This level of personalization shows your attention to detail and interest in the role. If you cannot find the hiring manager’s name, use a formal greeting like “Dear Hiring Manager” instead of a generic greeting. (Image: hiring-manager.webp)

Address the Hiring Manager by Name

Making a personal connection with the hiring manager is one of the best ways to get noticed. Do your research and find out the hiring manager’s name. Addressing your cover letter to a specific person creates a stronger connection and shows that you have taken the time to learn about the company and the role. If you cannot find a specific person’s name, use the title instead. It is important to make a good impression, and research is an important step. By starting your cover letter with a personal greeting, you signal that you are serious and committed to the role.

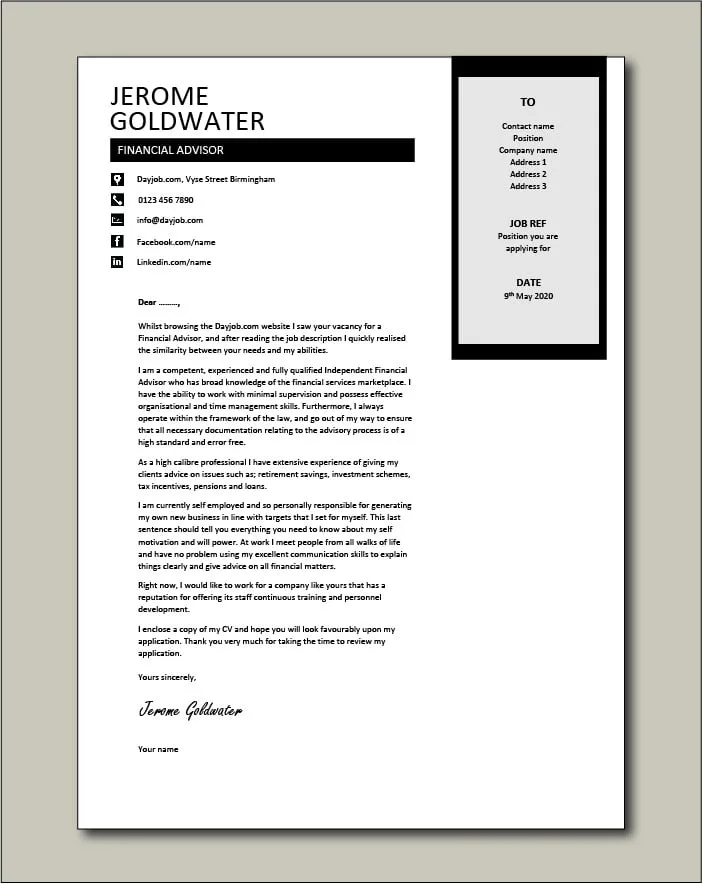

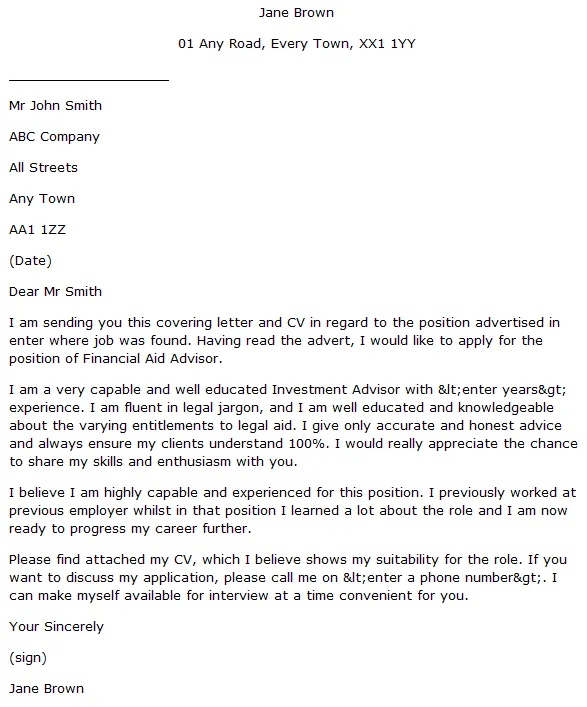

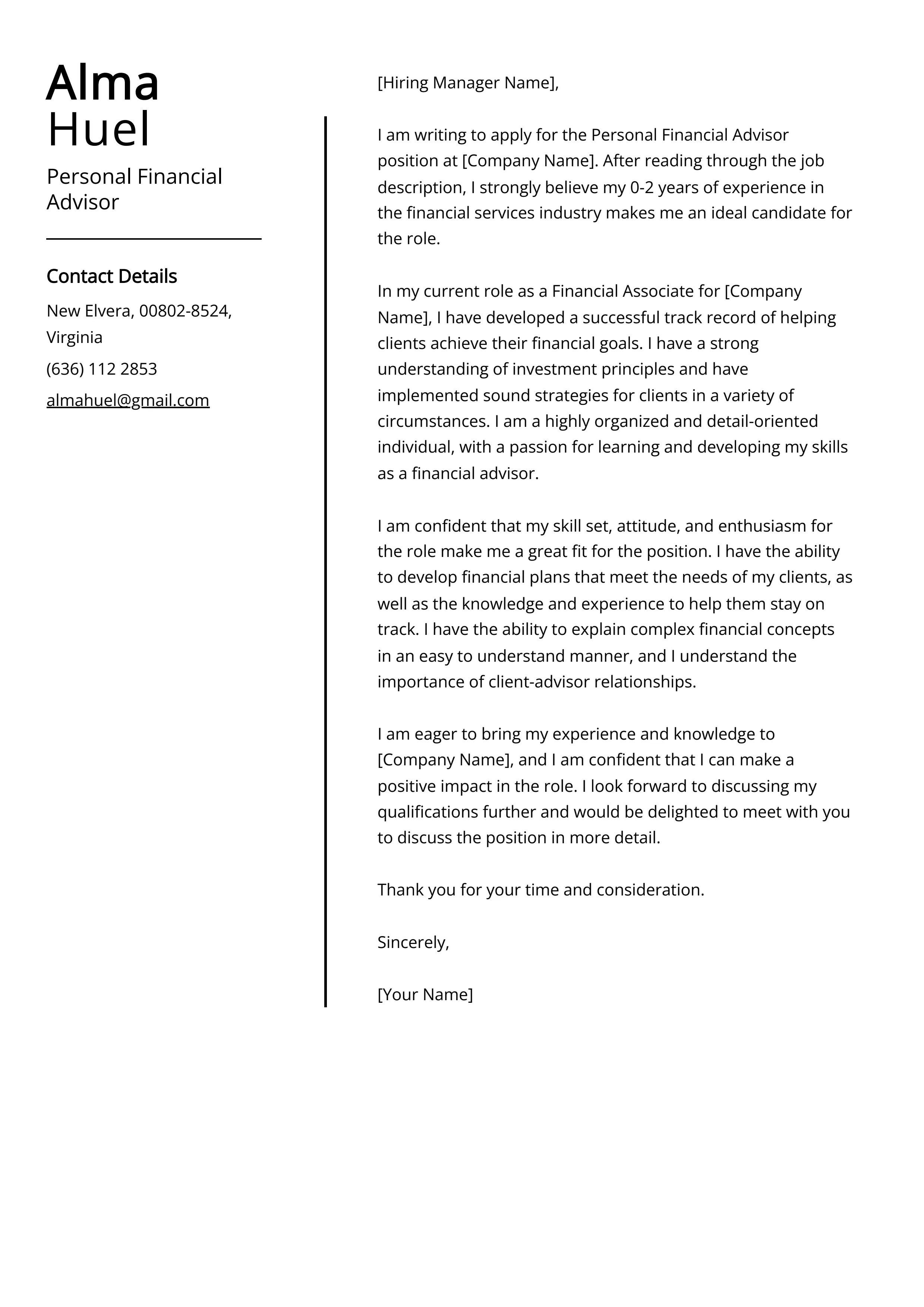

Explain Why You’re Interested in the Role

In your cover letter, clearly state why you are interested in the role and the company. Highlight what excites you about the opportunity and how it aligns with your career goals. Express your enthusiasm for the company’s mission, values, or recent achievements. Demonstrate that you are familiar with the company’s work and the challenges it faces. Explain why you chose this role specifically and what skills you bring to the table. Expressing your interest will show the hiring manager that you are genuinely interested in the position and the company. (Image: financial-advisor-cover-letter-1.webp)

Focus on What You Can Offer the Employer

Your cover letter should focus on what you can offer the employer, rather than simply listing your qualifications and experience. Highlight your skills and how they benefit the company. Demonstrate how your experience can help solve their problems, achieve their goals, or improve their performance. Think about the value you can bring to the team. Outline how you can increase client satisfaction, generate new business, or improve overall efficiency. By focusing on the value you bring, you will make your cover letter more appealing to the hiring manager. Sell yourself by explaining how your skills and experiences align with their needs, and demonstrate how you can make a difference. (Image: financial-advisor-cover-letter-1.webp)

Proofread and Edit Your Cover Letter

Before submitting your cover letter, proofread it carefully for any grammatical errors, spelling mistakes, or typos. Ensure your sentences are clear, concise, and easy to read. A well-written, error-free cover letter reflects professionalism and attention to detail, which are essential qualities for a financial advisor. Ask a friend or colleague to review your cover letter for feedback. They may catch errors that you have missed. Make sure your formatting is consistent and visually appealing. Use a professional font and proper spacing. Finally, make sure your cover letter is tailored and relevant to the job description. (Image: cover-letter-proofreading.webp)

Writing a standout financial advisor cover letter requires careful planning, research, and attention to detail. By following these tips, you can create a compelling cover letter that showcases your qualifications, highlights your achievements, and demonstrates your understanding of the industry. Your cover letter should focus on the value you can bring to the employer and should be tailored to each specific role. By following these guidelines, you can increase your chances of getting noticed and landing your dream job.